Win McNamee

Win McNamee

It will be a holiday-shortened trading week, but it will not be short on news events. The massive news event will come on Wednesday at 2 PM with the release of the November Fed minutes. These minutes will likely reverse the equity market’s celebration following a lower-than-expected October CPI report, as the Fed has a different view and is already pushing back hard.

Since the release of that CPI report on November 10, Fed-speak has been crystal clear – slower rate hikes do not mean a lower terminal rate, and one better-than-expected CPI report isn’t going to change the path of monetary policy. Ultimately, these speakers seem to think rates are going even higher.

St. Louis Fed Governor James Bullard suggested dovish assumptions about monetary policy justified additional rate hikes.

The November FOMC statement indicated the likelihood of a slower pace of rate hikes coming, while the FOMC press conference indicated that the terminal rate was likely to be higher than previously expected in September. Since the FOMC meeting, a strong case has been laid out by many FOMC members for the overnight rate to head over 5% and potentially to go as high as 5.25% in 2023.

If this message of higher rates is correctly delivered in the FOMC minutes, then it seems more likely than not that the equity market rally since the October CPI report in mid-November should not only pause but reverse.

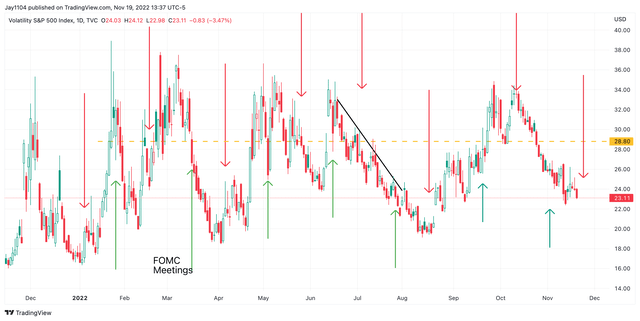

Additionally, the VIX should rise sharply heading into the FOMC meeting on December 14. Not on worries over a 50 or 75 bps rate hike but due to concerns over the Fed’s Summary of Economic Projections and the committee’s dot plot for terminal rate for the end of 2023.

In fact, throughout 2022, there has been a pattern of the VIX rising or falling into the FOMC meeting following the market’s perception of the Fed minutes. Currently, the VIX is trading towards the lower end of its trading range, around 23. The last time the VIX was this low heading into the release of the FOMC minutes came back on August 17, which also marked the end of the August rally and was followed by a sharp rise in the VIX and a very sharp decline in the S&P 500. The same thing also happened at the beginning of April, which also marked the end of the March rally, and early January, which marked the market peak.

TradingView

TradingView

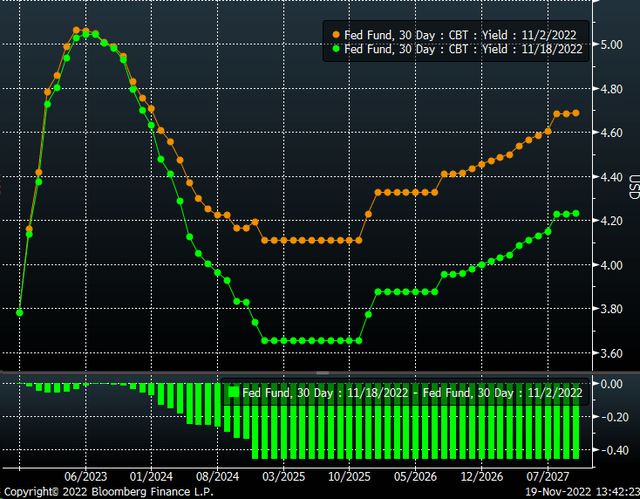

The bond market is already anticipating the more hawkish commentary out of the Fed minutes to be released this week. The Fed funds rates again call for the peak rate to be above 5% and back to levels seen immediately following the November FOMC meeting. Additionally, that peak rate is now seen coming in July instead of May, incorporating smaller rate hikes.

Bloomberg

Bloomberg

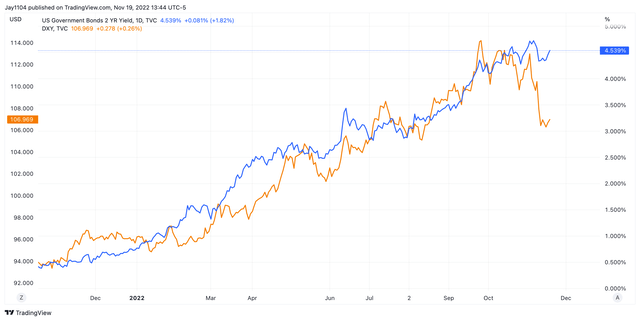

The view of higher rates has also helped lift the 2-year yield, moving it back above 4.5%, and stopped the bleeding of the dollar index. These are critical signs that the bond and currency markets are listening to what the FOMC members are saying and taking the calls for higher rates very seriously. The Fed minutes should enforce the view of the Fed officials and should only help to push the dollar and rates even higher.

Higher rates and a strong dollar should help financial conditions tighten, pushing stock prices lower and increasing implied volatility levels.

TradingView

TradingView

Just in case the market doesn’t respond appropriately to these minutes. The Fed is taking no chances heading into the FOMC meeting this time and will ensure that there will be no mix-ups from a potential article drop heading into the December meeting. There will be no repeat of the October version of the dovish pivot.

This time Jay Powell will take things into his own hands and talk for an hour at the Brookings Institute on November 30, starting at 1:30 PM ET. The talk is even more critical because it will come one day before the official FOMC blackout period starts heading into the December 14 FOMC meeting. It will be Powell’s chance to make sure the market does not veer off course over those two weeks.

The Fed has been telling the market all year that it intended to raise rates aggressively and wanted financial conditions to tighten. Yes, there have been countertrend rallies along the way, but if one thing is clear, the Fed has been committed to higher rates. If the minutes do not deliver that message this week, Powell will be sure to do on November 30 what he did on August 26 at Jackson Hole, putting the hammer down on the equity market again.

(*The Free Trial offer is not available in the App store)

See why Reading The Markets has been one of the fastest-growing Seeking Alpha marketplace services in 2022.

Reading the Markets helps readers cut through all the noise by delivering stock ideas and market updates.

This article was written by

I am Michael Kramer, the founder of Mott Capital Management and creator of Reading The Markets, an SA Marketplace service. I focus on macro themes and trends, look for long-term thematic growth investments, and use options data to find unusual activity.

I use my over 25 years of experience as a buy-side trader, analyst, and portfolio manager, to explain the twists and turns of the stock market and where it may be heading next. Additionally, I use data from top vendors to formulate my analysis, including sell-side analyst estimates and research, newsfeeds, in-depth options data, and gamma levels.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Charts used with the permission of Bloomberg Finance LP. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr. Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer’s views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer’s analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer’s statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Past performance of an index is not an indication or guarantee of future results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index may be available through investable instruments based on that index. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment.