The 30-share BSE Sensex climbed 327.05 points or 0.54 per cent to settle at 61,167.79 on Monday. During the day, it jumped 382.05 points or 0.62 per cent to 61,222.79.

Trending Photos

Equity benchmarks started the first day of trade of the New Year on a positive note and ended with smart gains, propelled by buying in index majors Reliance Industries and ICICI Bank amid a firm trend in European markets.

The 30-share BSE Sensex climbed 327.05 points or 0.54 per cent to settle at 61,167.79 on Monday. During the day, it jumped 382.05 points or 0.62 per cent to 61,222.79.

The broader NSE Nifty advanced 92.15 points or 0.51 per cent to end at 18,197.45.

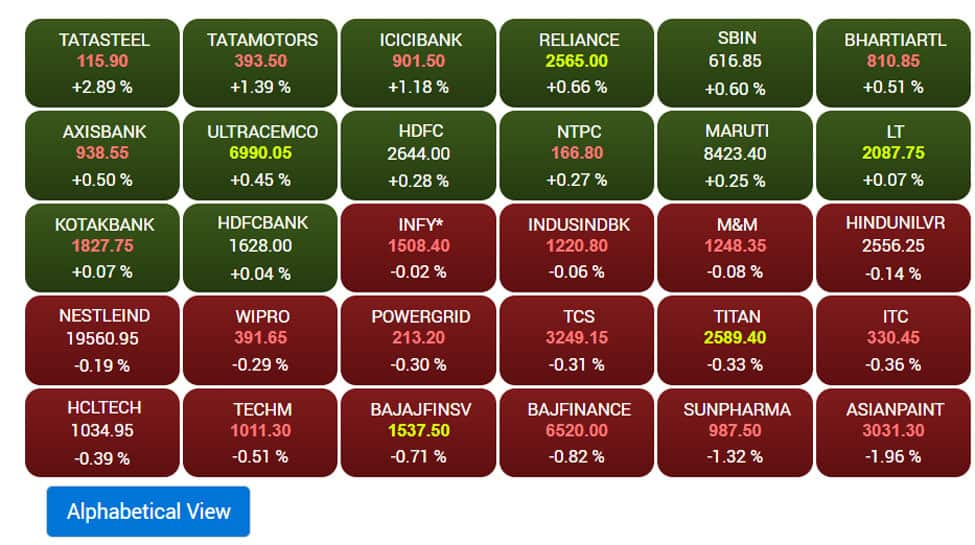

From the Sensex pack, Tata Steel, Tata Motors, ICICI Bank, Axis Bank, Mahindra & Mahindra, Reliance Industries, NTPC and Bharti Airtel were the prominent winners.

However, Asian Paints, Titan, Tech Mahindra, Nestle and Hindustan Unilever were among the major laggards.

Sensex touched its all-time high of 63,583.07 points on December 1 after hitting its 52-week low of 50,921.22 points on June 17.

Sensex jumped 10,502.49 points or 21.99 per cent last year.

Stay with us for the live updates on stock market

Sensex, Nifty live updates: Markets end on a positive note

Stock markes ended on a positive note on the first day of the New Year 2022. Elsewhere in Asia, equity markets in Seoul ended lower. Equity exchanges in Europe were trading in the green in mid-session deals. Markets in the US had ended lower on Friday. International oil benchmark Brent crude climbed 2.94 per cent to USD 85.91 per barrel. Foreign Institutional Investors (FIIs) offloaded shares worth a net Rs 2,950.89 crore on Friday, according to exchange data.

Stock marketl live updates: Rupee falls 14 paise to close at 82.75 against US dollar

The rupee started the New Year on a muted note, declining 14 paise to close at 82.75 (provisional) against the US dollar on Monday as rising crude oil prices and sustained foreign fund outflows weighed on investor sentiment. At the interbank foreign exchange market, the rupee opened lower at 82.66 against the greenback and witnessed an intra-day high of 82.56 and a low of 82.78. It finally settled at 82.75, down 14 paise over its previous close.

Stock market live updates: Gold futures gain Rs 110 to Rs 55,127

Gold price increased by Rs 110 to Rs 55,127 per 10 gram in futures trade as speculators created fresh positions on a firm spot demand. On the Multi Commodity Exchange, gold contracts for February delivery traded higher by Rs 110 or 0.2 per cent at Rs 55,127 per 10 gram in a business turnover of 13,921 lots. Fresh positions built up by participants led to the rise in gold prices, analysts said. Globally, gold was trading 0.01 per cent higher at USD 1,826.20 per ounce in New York.

Stock market live updates: Silver futures rise on spot demand

Silver prices rose by Rs 175 to Rs 69,588 per kilogram in futures trade as participants widened their bets amid a firm spot demand. On the Multi Commodity Exchange, silver contracts for March delivery gained Rs 175 or 0.25 per cent to Rs 69,588 per kg in 24,423 lots. Analysts said the rise in silver prices was mainly due to fresh positions built up by participants amid a positive trend in the market. Globally, silver was trading 0.87 per cent higher at USD 24.04 per ounce in New York.

Stock market live updates: Guar gum futures fall on low demand

Guar gum prices fell by Rs 33 to Rs 12,713 per five quintal in the futures market as traders offloaded their holdings in line with a weak trend in the spot market. On the National Commodity and Derivatives Exchange, guar gum for January delivery declined by Rs 33 or 0.26 per cent to Rs 12,713 per five quintal in 18,675 lots. Marketmen said slackness in demand in the spot market and ample supplies from growing regions put pressure on guar gum prices.

Stock market live updates: Coriander futures rise on spot demand

Coriander prices gained Rs 60 to Rs 8,106 per quintal in futures trade as speculators increased their holdings, tracking a firm trend in the spot market. On the National Commodity and Derivatives Exchange, coriander contracts for December delivery traded higher by Rs 60 or 0.74 per cent at Rs 8,106 per quintal with an open interest of 8,165 lots. A firm trend in the spot market and restricted supplies from producing regions pushed up coriander prices, market analysts said.

Stock market live updates: Cottonseed oil futures fell on soft demand

Cottonseed oil cake prices declined by Rs 7 to Rs 2,985 per quintal in futures trade as participants reduced their bets following weak trends in spot markets. On the National Commodity and Derivatives Exchange, cottonseed oil cake for January delivery fell by Rs 7 or 0.23 per cent to Rs 2,985 per quintal with an open interest of 32,290 lots. Analysts said sell-off by participants at existing levels amid subdued trend in market mainly weighed on cottonseed oil cake prices.

Stock market live updates: Zinc futures rise on spot demand

Zinc prices increased by Rs 1.30 to Rs 269.30 per kilogram in the futures trade, amid a pick-up in spot demand. On the Multi Commodity Exchange, zinc contracts for January delivery traded higher by Rs 1.30 or 0.49 per cent at Rs 269.30 per kg with a business turnover of 2,126 lots. Marketmen said widening of positions by participants, following a pick-up in demand from consuming industries kept zinc prices higher in the futures trade.

Stock market live updates: Aluminium futures rise on fresh bets

Aluminium prices increased by 0.19 per cent to Rs 208.90 per kilogram in futures trade as speculators built up fresh positions amid a positive trend in the spot market. On the Multi Commodity Exchange, aluminium contracts for January delivery increased by 40 paise or 0.19 per cent to Rs 208.90 per kg in a business turnover of 4,121 lots. Analysts said fresh positions created by traders amid demand from consuming industries supported aluminium prices in the futures market.

Stock market live updates: Crude oil futures gain on spot demand

Crude oil prices rose by Rs 59 to Rs 6,614 per barrel in futures trade as participants increased their positions following a firm spot demand. On the Multi Commodity Exchange, crude oil for January delivery traded higher by Rs 59 or 0.9 per cent at Rs 6,614 per barrel in 5,739 lots. Analysts said raising of bets by participants kept crude oil prices higher in futures trade. Globally, West Texas Intermediate crude oil was up by 2.37 per cent at USD 80.26 per barrel, and Brent crude traded 2.94 per cent higher at USD 85.91 per barrel in New York.

Stock market live updates: Copper futures gain on higher demand

Copper prices rose by 0.29 per cent to Rs 720.80 per kilogram in the futures market on the back of higher spot demand. On the Multi Commodity Exchange, copper contracts for delivery in January traded higher by Rs 2.10 or 0.29 per cent at Rs 720.80 per kg in a business turnover of 4,284 lots. Analysts attributed the rise in copper prices to raising of bets by participants.

Nifty, Senex live updates: M&M Dec PV sales rise 61% to 28,445 units

Mahindra & Mahindra on Monday reported 61 per cent increase in passenger vehicle sales at 28,445 units for December 2022. The company had sold 17,722 units in the same month in 2021, M&M said in a statement. Utility vehicle sales grew 62 per cent to 28,333 units last month as against 17,469 units in the year-ago period, it added.

Stock market live updates: Hyundai Motor elevates Tarun Garg as COO

Hyundai Motor India Ltd on Monday announced senior management elevations, including that of Tarun Garg as Chief Operating Officer.

Garg, who was earlier Director (Sales, Marketing & Service) will oversee sales, marketing, service and product strategy in his new role, Hyundai Motor India Ltd (HMIL) said in a statement. As part of the changes in its senior management leadership, HMIL also said Gopala Krishnan CS, Vice President (Production) has been elevated as Chief Manufacturing Officer (CMO) overseeing production, quality management and supply chain.

The elevations are effective from January 1, 2023, it added. In addition to their new elevated roles, Tarun Garg and Gopala Krishnan CS will continue to serve as whole-time directors on the HMIL board, the company said. HMIL Managing Director and CEO Unsoo Kim said,”The elevations stand testimony to Hyundai Motor India’s commitment to recognise and appreciate its leadership.”

Stock market live updates: PTC India shareholders approve final dividend of Rs 5.80 per equity share

Power trading solutions provider PTC India said its shareholders have approved a final dividend of Rs 5.80 per equity share for 2021-22. This final dividend is in addition to the interim dividend of Rs 2 per equity share, a company statement said. The shareholders during the annual general meeting (AGM) on December 30, 2022 approved the final dividend in addition to the interim dividend, making it the highest-ever dividend declared by the company, it said.

Stock market live: India’s current account deficit projected at $106bn

Credit rating agency Acuite Ratings and Research has revised downward Indias current account deficit to $106 billion in FY23. In a report released on Monday, Acuite Ratings said it is revising the forecast for the current account deficit to $106 billin from the earlier levels of $130 billion. The Balance of Payment (BoP) deficit is estimated at $38 billion down from $60 billion estimated earlier, Acuite Ratings said. According to the rating agency, the moderation in the monthly trade deficit and the softening of crude oil prices till now in Q3FY23 has made it to revise its earlier forecast as to current account deficit and BoP, reported IANS.

Stock market live updates: Judgement on Demonetisation

Demonetisation: Justice B V Nagarathna differs from Justice B R Gavai’s judgment on point of Centre’s powers under section 26(2) of RBI Act.

Stock market live updates: Judgement on Demonetisation

Demonetisation: Notification dated November 8, 2016 valid, satisfies test of proportionality, says Supreme Court.

Stock market live updates: Judgement on Demonetisation

Not relevant whether objective achieved or not: Justice B R Gavai of Supreme Court on demonetisation.

Stock market live updates: Judgement on Demonetisation

Demonetisation: Justice B R Gavai says Centre’s decision-making process cannot be flawed as there was consultation between RBI and govt.

Stock market live updates: Judgement on Demonetisation

SC dismisses batch of pleas challenging Centre’s 2016 decision on demonetisation, upholds move.

Stock market live: Tata Steel major gainer in sensex pack

Stock market live updates: Sensex climbs 123 points

Sensex climbs 123.53 points to 60,964.27 in early trade; Nifty advances 47.9 points to 18,153.20

Stock market live updates: Demonetisation judgement today

A five-judge Constitution bench headed by Justice S A Nazeer, who will retire on January 4, is likely to pronounce its verdict on the matter on January 2, when the top court will reopen after its winter break. Besides Justices Nazeer, Gavai and Nagarathna, the other members of the five-judge bench are Justices A S Bopanna and V Ramasubramanian.

Stock market live updates: SGX Nifty sees negative opening

Nifty futures on the Singapore Exchange saw a negative opening. It was trading traded 40 points or 0.22 percent lower at 18,183. A negative start at Dalal Street on Monday is likely.

Stock market live updates: SC to pronounce judgement on Demonetisation plea today

The Supreme Court is scheduled to pronounce its judgment on Monday on a batch of pleas challenging the government’s 2016 decision to demonetise currency notes of Rs 1,000 and Rs 500 denominations. The Supreme Court has heard a batch of 58 petitions challenging the demonetisation exercise announced by the Centre on November 8, 2016.

More Stories

Partner sites

© 1998-2022 INDIADOTCOM DIGITAL PRIVATE LIMITED, All rights reserved.