Just_Super

Just_Super

Bit Digital (NASDAQ:BTBT) is primarily a Bitcoin (BTC-USD) mining business based in the United States. I’ve previously covered Bit Digital for Seeking Alpha several months ago. At the time, the mining space was just starting to deal with issues from low BTC prices and counter party bankruptcies. In my view, this was a headwind for Bit Digital specifically because of its use of mining hosts. While the article probably read pretty harsh if you’re a BTBT bull, the one positive thing that I did mention was how good the company’s balance sheet was. With another quarter of performance and initiatives, we can see if things are getting better or worse for Bit Digital fundamentally.

Bit Digital reported Q3 earnings on December 7th and disclosed $9.1 million in revenue, $2.6 million in gross profit, and a $12.9 million operating loss after administrative expenses and amortization. The good news is the company still has a strong portfolio of assets and virtually no debt:

Source: Seeking Alpha

Bit Digital’s digital assets are made up of Bitcoin, Ethereum (ETH-USD), USDC, and ETH derivatives. In Bit Digital’s last production update, it shared a modest monthly mined figure of 130 BTC. For the quarter, the company mined approximately 427 BTC, down slightly from Q3’s 429. Despite having exposure to third parties through the company’s hosted mining approach, Bit Digital has been able to get through the miner margin squeeze without selling off a large portion of Bitcoin. This has not been the case broadly in the public miner space as other companies have had to fire sell Bitcoin stacks.

Source: company press releases, sorted by BTC Treasury

Bit Digital’s avoidance of risk has enabled it to claim the fifth largest public Bitcoin miner BTC treasury simply by not blowing itself up with leverage. Despite showing an ability to competently maintain a BTC position, Bit Digital might now be just as appealing for its ETH position and how the company plans to monetize it.

Last month Bit Digital announced it had begun Ethereum staking through Blockdaemon’s liquid staking solution Portara. Liquid staking is different from typical direct staking because it allows the staker to mint a liquid derivative token of the ETH that has been staked for further use in DeFi.

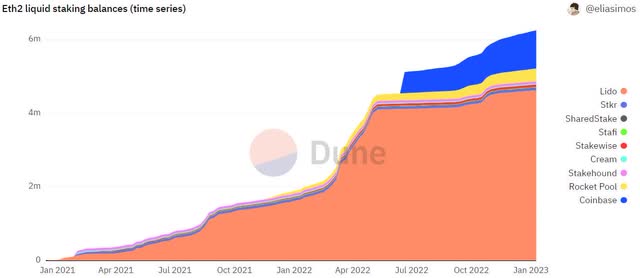

ETH Liquid Staking (Dune Analytics/eliasimos)

ETH Liquid Staking (Dune Analytics/eliasimos)

Liquid staking is a very popular way to stake on Ethereum because ETH stake withdrawals won’t be enabled until the Shanghai upgrade which is likely coming in March. Because there is risk in staking an asset without a clear time expectation for withdrawal, roughly 43% of the ETH staked has been through liquid staking protocols.

In my October article covering BTBT, I noted that the company would have to scale up its ETH position if it wants to generate meaningful rewards from staking:

But if Bit Digital is to shift to a model where a large percentage of its revenue comes from Ethereum staking, it will likely have to ramp up the ETH in its treasury to generate a meaningful return as a new revenue segment.

Bit Digital has certainly been able to do that as the company’s ETH balance is now 8,799.9, up from 3,684 ETH at the end of August. So far, we know that 2,164 ETH have been staked from the company’s total ETH stash as of December 20th. Though it is expected that most of the company’s ETH will end up in stake whether directly or through a liquid staking application like Portara:

The Company intends to continue accumulating Ethereum and stake substantially all of its ETH position over time

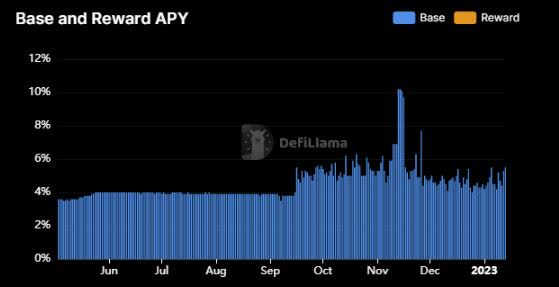

Beyond what Bit Digital returns from an ETH reward standpoint, the company could consider putting the liquid derivatives to work as well through DeFi lending protocols. As an example, Lido Finance’s (LDO-USD) stETH derivative token has generally returned somewhere between 4-5% APY since the completion of the merge in September:

stETH APY Trend (DeFi Llama)

stETH APY Trend (DeFi Llama)

The company could certainly try to do something similar with its own liquid staked tokens should it decide to participate in on-chain lending.

Liquid staking relies on asset pegs and trust in the ability to redeem. We’ve seen staked ETH derivative tokens trade at a discount before. As of article submission, Coinbase’s (COIN) cbETH token trades a 1.1% discount to ETH. Bit Digital doesn’t have a large debt position on the corporate balance sheet, but as the company ramps up its ETH staking footprint, it will be introducing counter party risk on the balance sheet through derivative tokens.

I like that the company is diversifying its business from just a Bitcoin miner to an Ethereum staker. In my view, the liquid staking approach is probably a good one for a publicly traded company because it allows BTBT to sell off the ETH derivatives should it have to in a pinch. I also think going with an institutional grade staking solution that offers slashing insurance and KYC-compliance like Blockdaemon is a responsible way to do liquid staking on Ethereum. I don’t currently have any position in BTBT stock. That said, I do think the name is getting more interesting and there are probably worse ways to play a crypto equity relief rally.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Decode the digital asset space with BlockChain Reaction. Forget about the dog money. With over 20,000 coins, malinvestment was begging to be purged. But not every coin is disaster. In BCR I’ll help you find the ones that have staying power. Service features include:

Crypto Winter can be cold and brutal. But there is value in public blockchain and distributed ledger technology. Sign up today and position your portfolio for the future!

This article was written by

5 years as a media research analyst. Mainly covering crypto, metal, and media equities. Operator of Heretic Speculator newsletter where I share additional thoughts on finance with more of a social backdrop.

Disclosure: I/we have a beneficial long position in the shares of HUT, BTC-USD, COIN, ETH-USD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I’m not an investment advisor. I share what I do and why I do it.