![]() Slobodan Drvenica

Slobodan Drvenica

Windsor Brokers

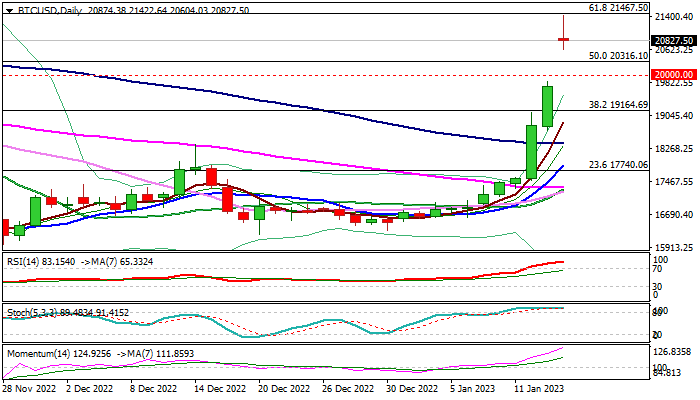

Bitcoin opened with a gap-higher on Monday and hit the highest since mid-September, in extension of sharp bullish acceleration last Thu/Fri.

Surge through psychological 20 and 21K after gapping higher by over 1100 pips adds to strong bullish stance as the latest acceleration fully retraced post-FTX crisis sharp fall.

Last week’s 16.5% advance marks the biggest weekly rally since the last week of July 2021 and some profit-taking could be a likely scenario as bulls cracked previous high at 21287 (Nov 4) and approach key Fibo barrier at 21467 (Fibo 61.8% of 25194/15437 bear-leg) and daily studies are strongly overbought.

Significantly improved sentiment on signs that the US inflation entered downward trajectory that would prompt Fed to further ease the pace of rate hikes in the next policy meeting on Feb 1, is expected to continue inflating Bitcoin’s price in the near future.

Bulls are likely to take a breather for consolidation, with dips to find solid supports at 20316 (broken 50% retracement of 25194/15437) and 20000 (psychological), where pullback should ideally stall to keep today’s gap unfilled and bullish structure intact.

Sustained break of 21287/21467 pivots would open way for extension towards 22761 (falling 200DMA) and 22892 (Fibo 76.4%).

Res: 21287; 21467; 22000; 22761.

Sup: 20604; 20316; 20000; 18691.

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

The highly-referenced Bitcoin Fear and Greed Index moved into neutral territory over the weekend following several months of fear.

Shiba Inu, the second largest meme coin in the crypto ecosystem, dropped details of the upcoming launch of layer-2 scaling solution Shibarium. Three Shiba Inu ecosystem tokens: SHIB, BONE and LEASH will derive utility from the scaling solution.

Bitcoin opened with a gap-higher on Monday and hit the highest since mid-September, in extension of sharp bullish acceleration last Thu/Fri.

Ethereum staking, which involves locking ETH tokens in a deposit contract and earning the opportunity of validating transactions and yielding the altcoin as a reward, has increased ahead of a major event for the altcoin: the Shanghai hard fork, which could happen in March 2023.

BTC looks healthy and ready to retest one of the significant hurdles at $19,248. Network activity shows enthusiasm, but on-chain metrics reveal this move cannot sustain. Two key levels to pay attention to include $19,248 to the upside and $15,443 to the downside.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Opinions expressed at FXStreet are those of the individual authors and do not necessarily represent the opinion of FXStreet or its management. FXStreet has not verified the accuracy or basis-in-fact of any claim or statement made by any independent author: errors and omissions may occur. Any opinions, news, research, analyses, prices or other information contained on this website, by FXStreet, its employees, clients or contributors, is provided as general market commentary and does not constitute investment advice. FXStreet will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from use of or reliance on such information.

Bitcoin outlook: Bulls to stay intact while today's gap remains unfilled – FXStreet

Date:

- Advertisement -

- Advertisement -