Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

Motley Fool Issues Rare “All In” Buy Alert

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

Roblox (RBLX -2.49%) stock is down 69% year to date thanks to slowing growth through the first half of the year. However, the stock hit a 52-week low of $21.65 months ago, and shares are currently trading around $33. There could be more upside in 2023.

After reporting declining bookings (a non-GAAP measure of revenue) in the second and third quarters, Roblox posted double-digit growth in bookings in the third quarter. Daily active users and hours of time spent on the platform reached new highs in the quarter.

The stock still looks expensive on a price-to-sales basis, but this could be the right time to start building a position.

Roblox is seeing top-line growth reaccelerate after bookings declined in the first half of the year. While Wall Street analysts are concerned about the company’s losses on the bottom line, key performance metrics are turning positive, which usually precedes user monetization. Bookings grew 10% year over year last quarter, but excluding foreign currency changes, bookings would have increased by 15%.

Image source: Roblox Q3 earnings presentation.

Momentum is carrying into the fourth quarter. CEO David Baszucki said the company had a “wonderful October,” with bookings up 13% excluding currency exchange rates.

Roblox seems to be benefiting from a recent surge in demand for new gaming experiences. Leading game companies such as Activision Blizzard (ATVI 0.39%) and Electronic Arts (EA 1.11%) announced record sales and engagement for their latest releases. And the launch of Call of Duty: Modern Warfare 2 eclipsed $1 billion in sales within the first 10 days, the fastest rate of sales in the series’ history.

Meanwhile, EA reported “record-breaking” results for FIFA 23, with over 10 million players within the first week. This is all good news for Roblox since a rising tide can lift all boats.

Roblox is proving it can compete with the big game companies for older players. Total daily active users grew 24% year over year, reaching an all-time high of nearly 59 million — which also represents a small acceleration over the second quarter.

The fastest-growing age bracket is 17-24, which grew by 41%. Older players tend to have more money to spend than younger players, so this bodes well for more growth.

Image source: Roblox.

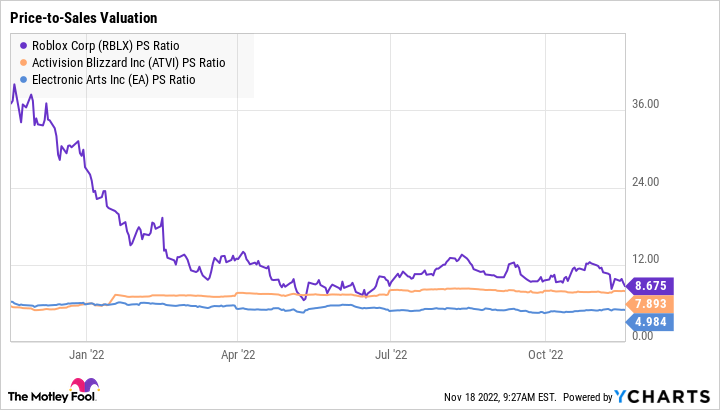

The bears will point to Roblox’s premium price-to-sales ratio over the more profitable gaming companies like Activision and EA as a reason to avoid the stock, although that premium has narrowed significantly during the recent sell-off, making Roblox more attractive.

Data by YCharts

However, Roblox’s faster rate of top-line growth and untapped opportunities to monetize its user base justify the premium. The launch of in-game advertising and a limited edition marketplace, both expected in 2023, will be huge first steps to improving user monetization on the platform.

With the stock sitting about 60% above its 52-week low on top of accelerating growth, Roblox is already looking the part of the market leader coming out of this bear market. I believe the market is undervaluing the company’s opportunities to generate more revenue off one of the fastest-growing metaverse platforms in the world. It’s time to buy the stock before more growth potentially sends the stock even higher.

John Ballard has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Activision Blizzard and Roblox Corporation. The Motley Fool recommends Electronic Arts. The Motley Fool has a disclosure policy.

*Average returns of all recommendations since inception. Cost basis and return based on previous market day close.

Market-beating stocks from our award-winning analyst team.

Calculated by average return of all stock recommendations since inception of the Stock Advisor service in February of 2002. Returns as of 11/20/2022.

Discounted offers are only available to new members. Stock Advisor list price is $199 per year.

Calculated by Time-Weighted Return since 2002. Volatility profiles based on trailing-three-year calculations of the standard deviation of service investment returns.

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

Making the world smarter, happier, and richer.

Market data powered by Xignite.